This website is for intermediaries. Not an intermediary? Visit the customer website

Your Frequently Asked Questions

I need help with...

getting started with Vidaour products & criteria

the online application portal

Getting started

How do I register with Vida?

Registering with us is quick and simple. Click here to complete our simple online registration form.

You’ll need the following information to hand when you register:

Company name and Financial Services Register reference number.

Company registered address and office address (if different) including postcode.

Whether you are Directly Authorised (DA) or an Appointed Representative (AR). If

you’re an AR please select your network company name

Business submission route - via packager, club or network

Personal contact details

Do I have a BDM?

We do things a little differently at Vida. We have combined all our Intermediary-facing teams into one dedicated team of lending experts which we call V-Hub.

Through the V-Hub, you can:

get status updates on current cases.

get direct access to the Underwriter handling your case.

get quick answers to all your product, criteria or process questions.

get market insights and

commentary from our experts.

You can visit the V Hub, here

Can I talk to an Underwriter about my case?

Yes! Call the V-Hub on 03300 246 246 and speak directly to an experienced Underwriter about your client’s case.

What's your 'Service Pledge'?

Our Service Pledge - what is it?

At Vida, we’ve spent time creating a service that you can put your trust in, every time.

So much so, we’ve created the Vida Service Pledge – the most comprehensive service commitment ever seen from Vida!

Meaning we stick to our promises, and you get the commitment and consistency you deserve when submitting applications with us.

How it works?

Service excellence, or we'll refund the administration fee

The Vida Service Pledge promises that if you feel you haven’t had anything other than excellent service from us, we’ll refund the £180 application administration fee. It really is that simple!

Call our V-Hub

And remember, our V-Hub team and Underwriters are on hand to help you at every stage.

So why wouldn’t you come to Vida with your next case?

With our proposition, rates and service, we're the specialist lender you've always dreamed of.

Where can I find all your downloadable guides and product literature?

We’ve put all our useful documents in one place for your convenience. Find the documents you might need by visiting our Documents page

What is the V-Hub?

The V-Hub is our Intermediary Support Team, including Underwriters and Vida lending and criteria experts. They are available to speak to you directly about any of your queries, a new case, or an update on your existing case.

What are your Service Levels?

DIP Referral – 24 hours

Valuation receipt – 7 days

Initial Underwriter Review – 2 working days

Our products & criteria

What's your criteria on adverse credit?

Customer Credit Profiles

See where your customer fits within our Vida tiers.

Residential

| Criteria | VIDA 48 | VIDA 36 | VIDA 24 | VIDA 12 | VIDA 6 |

|---|---|---|---|---|---|

| Registered Defaults (months) | 0 in 48 | 0 in 36 | 0 in 24 | 0 in 12 | 0 in 6 |

| Registered CCJs (months) | 0 in 72 | 0 in 36 | 0 in 24 | 0 in 12 | 0 in 6 |

| Value of unsatisfied CCJs | £0 | £0 | £1,000 | £2,500 | £5,000 |

| Missed Mortgage/Secured Payments (months) | 0 in 36 | 0 in 36 | 0 in 12 | 0 in 12 | 0 in 6 |

| Unsecured Arrears (last 6 months) | 0 | 1 | 2 | 2 | 3 |

| Unsecured Missed Payments in the last 6 months Combined Value | £0 | £500 | £500 | £500 | £500 |

| Worst Status Secured Payments* (months) | 0 in 36 | 3 in 24 | 3 in 24 | 3 in 24 | 3 in 24 |

Vida 48 Registered Defaults (months) 0 in 48 Registered CCJs (months) 0 in 72 Value of unsatisfied CCJs £0 Missed Mortgage/Secured Payments (months) 0 in 36 Unsecured Arrears 0 Unsecured Missed Payments in the last 6 months Combined Value £0 Worst Status Secured Payments* (months) 0 in 36 VIDA 36 Registered Defaults (months) 0 in 36 Registered CCJs (months) 0 in 36 Value of unsatisfied CCJs £0 Missed Mortgage/Secured Payments (months) 0 in 36 Unsecured Arrears 1 Unsecured Missed Payments in the last 6 months Combined Value £500 Worst Status Secured Payments* (months) 3 in 24 Vida 24 Registered Defaults (months) 0 in 24 Registered CCJs (months) 0 in 24 Value of unsatisfied CCJs £1,000 Missed Mortgage/Secured Payments (months) 0 in 12 Unsecured Arrears 2 Unsecured Missed Payments in the last 6 months Combined Value £500 Worst Status Secured Payments* (months) 3 in 24 VIDA 12 Registered Defaults (months) 0 in 12 Registered CCJs (months) 0 in 12 Value of unsatisfied CCJs £2,500 Missed Mortgage/Secured Payments (months) 0 in 12 Unsecured Arrears 2 Unsecured Missed Payments in the last 6 months Combined Value £500 Worst Status Secured Payments* (months) 3 in 24 VIDA 6 Registered Defaults (months) 0 in 6 Registered CCJs (months) 0 in 6 Value of unsatisfied CCJs £5,000 Missed Mortgage/Secured Payments (months) 0 in 6 Unsecured Arrears 3 Unsecured Missed Payments in the last 6 months Combined Value £500 Worst Status Secured Payments* (months) 3 in 24

*All historic secured arrears must have been paid up to date for at least 6 months prior to application

Debt Management Plan/Debt Arrangement Schemes may be considered at Underwriter discretion - subject to satisfactory affordability

and conduct checks.

Bankruptcy/IVA/DRO/Trust Deed discharged over 6 years.

Previous Repossession in last 6 years not acceptable

Buy to Let

| Criteria | Vida 48 | Vida 24 | Vida 12 |

|---|---|---|---|

| Registered Defaults and CCJs (months) | 0 in 48 | 0 in 24 | 0 in 12 |

| Value of unsatisfied CCJs | £0 | £2,500 | £5,000 |

| Missed Mortgage / Secured Payments* (months) | 0 in 36 | 0 in 12 | 0 in 12 |

| Unsecured Arrears (last 6 months) | 0 | 1 | 3 |

| Unsecured missed payments in the last 6 months combined value | £0 | £500 | £500 |

*Worst status of 2 in the last 24 months and all historic arrears must have been paid up to date for at least 6 months prior to application.

• Debt Management Plan/Debt Arrangement Schemes may be considered at Underwriter

discretion - subject to satisfactory affordability and conduct checks.

• Bankruptcy/IVA/DRO/Trust Deed discharged over 6 years.

• Previous Repossession in last 10 years not acceptable.

Vida 48 Registered Defaults and CCJs 0 48 Value of unsatisfied CCJ’s £0 Missed Mortgage / Secured Payments* (months) 0 in 36 Unsecured Arrears (last 6 months) 0 Unsecured missed payments in the last 6 months combined value £0 VIDA 24 Registered Defaults and CCJs 0 in 24 Value of unsatisfied CCJ’s £2,500 Missed Mortgage / Secured Payments* (months) 0 in 12 Unsecured Arrears (last 6 months) 1 Unsecured missed payments in the last 6 months combined value £500 VIDA 12 Registered Defaults and CCJs 0 in the last 12 months Value of unsatisfied CCJ’s £5,000 Missed Mortgage / Secured Payments* (months) 0 in 12 Unsecured Arrears (last 6 months) 3 Unsecured missed payments in the last 6 months combined value £500

What is the maximum age you will lend up to?

Residential: Applicant’s stated retirement age or age 70, whichever is sooner.

Buy to Let: Mortgage to finish before 85th birthday

Do you lend in Scotland?

Yes, we lend in Scotland. These postcodes are currently acceptable; AB (excluding 36-38, 55), DD, DG (excluding 13, 14, 16), EH, FK (excluding 18-21), G, IV (excluding 4, 13, 21-23, 26, 27, 29, 33-35, 37-63), KA (excluding 27, 28), KW (excluding 1-7, 11+) KY, ML, PA (excluding 20-80), PH (excluding 20-42) and TD (excluding 3, 5-12.

Do you lend to Expats?

Yes! Our Expat range is designed to help UK Nationals living and working abroad purchase or remortgage a rental property in the UK. For full details of our Expat range, including the full list of acceptable countries please see our Expat Guide.

Do you lend to First Time Buyers / First Time Landlords

Yes, both First Time Buyers and First Time Landlords are acceptable.

A First Time Buyer is defined as an applicant who has never owned a residential property.

First time landlords who currently own a residential property are accepted. Considered for HMO and MUB purchase.

For full details see our Criteria Guide

What is the Maximum LTV?

The Maximum LTV for both Residential and Buy to Let Mortgages is 85%.

What's your criteria on VISAs

Foreign nationals will need to provide evidence of their right to reside in the UK. Those with a permanent right to reside, EU/EAA/Swiss with settled status or Indefinite leave to remain can borrow up to scheme limits.

Online application portal

I've forgotten my Broker Portal password - what should I do?

Click on the ‘Forgotten Password’ link on the log-in page and enter your email address.

We will then send you a link to reset your password

If your account has been locked please contact our V-Hub team on 03300 246 246 and select option 1.

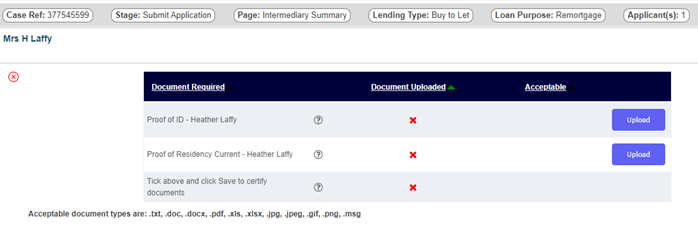

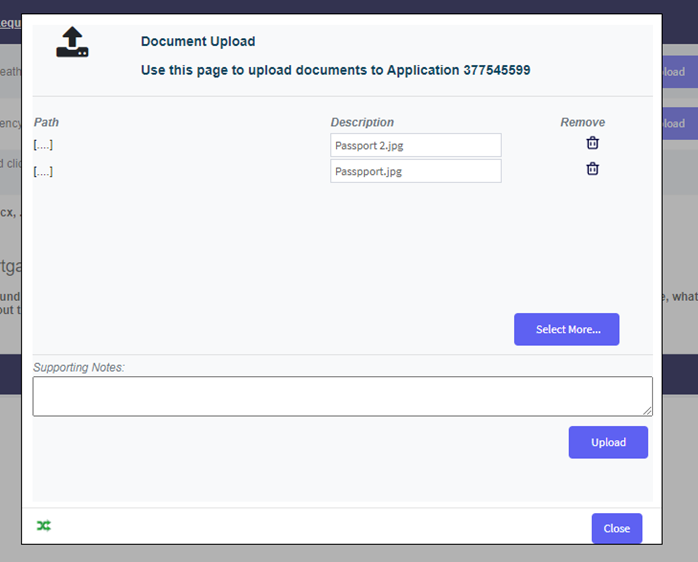

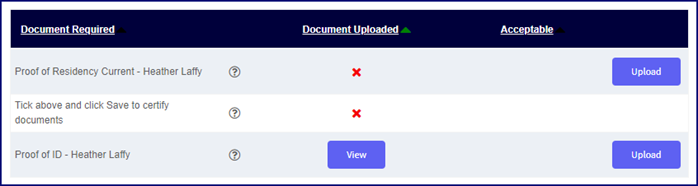

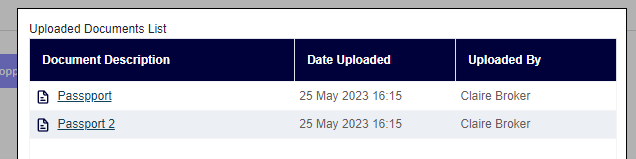

How do I upload any Mandatory documents?

On the Intermediary Summary page, click on ‘Upload’ next to the relevant item.

Select the relevant document(s) from your folder and click ‘Open’

Add any further descriptions or notes then click ‘Upload’

You can see your uploaded documents under ‘View’

Will you update me about the progress of my application?

Our Underwriters will call you after their initial review to go through any further documents needed for the case to proceed. After that, they will give you regular check in calls throughout the lifecycle of the Application, just to make sure you are comfortable with the requests and provide extra assistance.

Alternatively, you can call our V-Hub and get through to an Underwriter within 10 seconds on average and they will be able to assist.

How do I leave a message / note about my client's case?

On the Intermediary Summary page, click on Add New Note to add a message

Enter your message and click 'Save'

Click on 'Send Note to Case Owner' to notify us once your note has been saved

Talk to an Underwriter

We get it. All you want is a quick answer when you need it. Call the V-Hub on 03300 246 246 and speak to our experienced team. Monday - Friday: 9am - 5pm.

Prefer to email?

You can send your messages and enquiries to v-hub@vidahomeloans.co.uk and we'll get back to you ASAP.

Login

Already have everything you need? You can login to the Broker Portal to start a new mortgage application or head over to our Product Switch Hub to switch an existing customer to a new deal.